Legal Insights

Employee Incentives

Which Incentive Fits Whom? A Guide for Founders Who Want to Get It Right

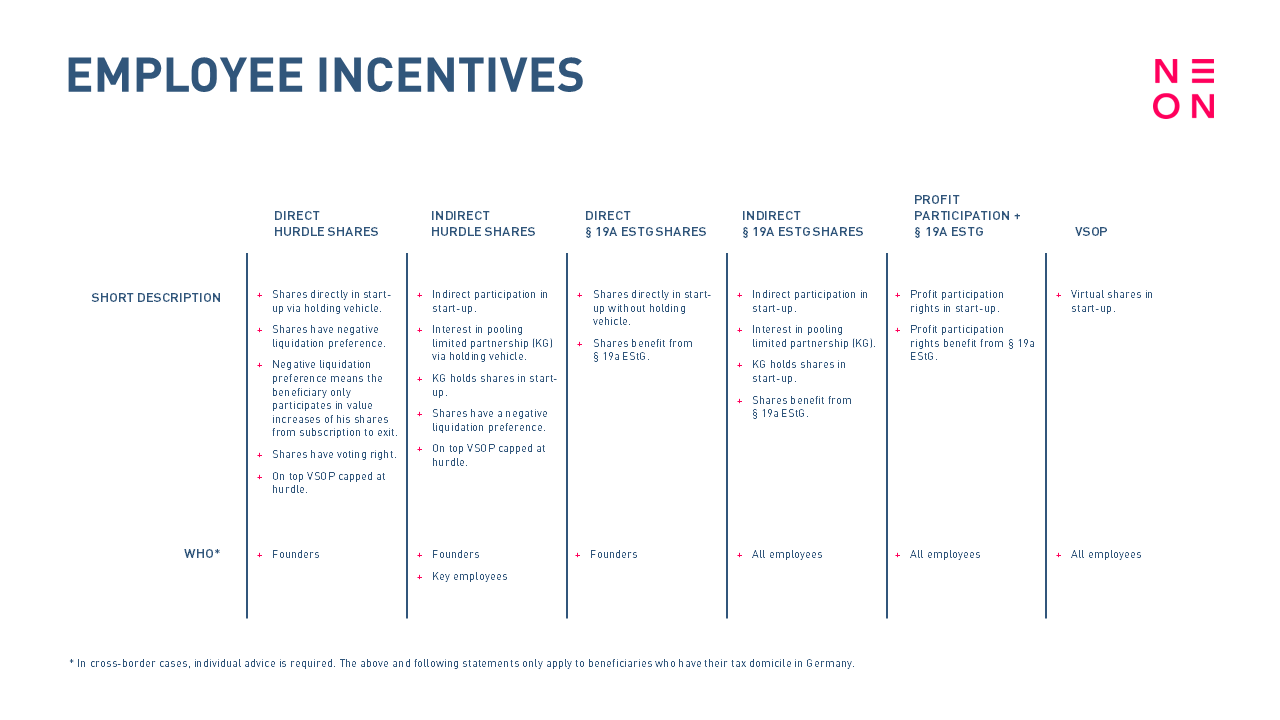

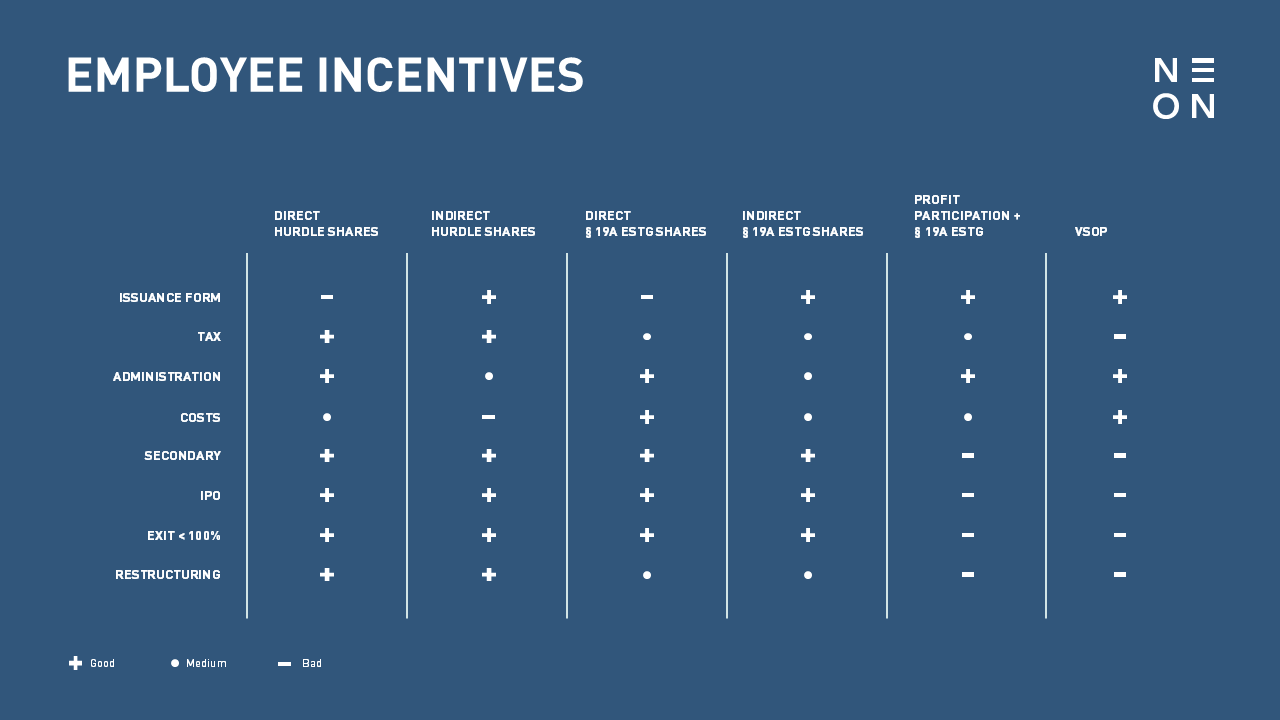

The right incentive model can enhance employee performance and loyalty, shape your company culture and accelerate growth. But let’s be real: incentives have become a maze – especially since the new tax benefit under § 19a EStG has come into play. If it feels hard to navigate, that’s because it is. We’ve distilled the six core models into upsides, trade-offs, and best‑fit use cases. Here’s how they compare:

Direct Hurdle Shares

- Best for: Founders

- Why: Real equity, shareholder rights & best tax benefits – ideal when you want to tie people directly to the company’s performance and future upside.

- Watch out: Not scalable. Each shareholder brings legal complexity. Obtaining a tax ruling is recommended.

Indirect Hurdle Shares (via Pooling LP)

- Best for: Founders + Key employees

- Why: You retain legal flexibility while offering a strong economic stake & best tax benefits. Avoids cluttering your cap table.

- Watch out: Structurally complex & most expensive model. Expert tax and legal advice is essential.

Direct § 19a EStG Shares

- Best for: Founders

- Why: Combines real equity with tax deferral & medium tax benefits, thereby bridging startup needs and employee protection. No tax ruling required.

- Watch out: Startup and beneficiaries must be eligible under § 19a EStG. Also: key employees as minority shareholders may present challenges.

Indirect § 19a EStG Shares (via Pooling LP)

- Best for: Broad employee base

- Why: The gold standard solution: Employees hold shares indirectly and still enjoy the § 19a EStG tax benefit. Pooling structure provides administrative sanity.

- Watch out: Setup can be intricate. Needs tailored legal architecture. Expensive. Eligibility under § 19a EStG required.

§ 19a EStG Profit Participation Rights

- Best for: Broad employee base

- Why: Medium tax benefits without full shareholder rights – think financial upside without governance drama.

- Watch out: Less emotional “ownership” feeling. Employees may not see it as true equity. Not ideal in restructuring and partial exit scenarios. Eligibility under § 19a EStG required.

VSOP

- Best for: Broad employee base

- Why: No shareholder rights, no notarization, and highly customizable. Still the go-to for early to mid-stage teams that favor speed, simplicity and lean governance.

- Watch out: Not tax-advantaged. And unless communicated well, virtual participation may feel not so valuable to some employees.

There’s no one-size-fits-all solution. Choose your incentive model based on who you’re incentivizing, how mature your startup is, and where you want to go.

to the top

^